littleton co sales tax 2020

Loghill Village CO Sales Tax Rate. Lower sales tax than 62 of North Carolina localities.

2016 Kia Soul Ev Incentives Specials Offers In Olympia Wa Kia Kia Soul Arapahoe

Littleton CO Sales Tax Rate.

. Building Inspections. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County. 4 Sales tax on food liquor for immediate consumption.

The current total local sales tax rate in Littleton CO is 4250. To access the system Click on Login. You can print a 8 sales tax table here.

Sales and use tax rate increase in 2022. Log Lane Village CO Sales Tax Rate. You can print a 875 sales tax table here.

What is the sales tax rate in Littleton Colorado. Census is coming in 2020 and an accurate count is really important to the City of Littleton. For tax rates in other cities see Colorado sales taxes by city and county.

The County sales tax rate is 025. This document provides the jurisdiction codes by county to ensure proper registration of locations for accurate filing and distribution of state-collected sales tax to local and special district tax jurisdictions. This Website allows you 24-hour access to sales tax returns and sales tax payments.

This is one of. The 8 sales tax rate in Littleton consists of 625 Illinois state sales tax and 175 Schuyler County sales tax. Colorado Department of Revenue Sales Tax Changes - Effective December 1 2018.

Effective January 1 2022 businesses should begin. You will need your City of Littleton SalesUse Tax Account Number Customer ID Number as well as your PIN Password. Littleton businesses which have completed the Business License SalesUse Tax Application may be listed in the free Littleton Business Directory.

Littleton voters approved a 075 sales and use tax rate increase in November 2021 to fund capital improvement projects and ensure long-term financial stability. Did South Dakota v. The 875 sales tax rate in Littleton consists of 29 Colorado state sales tax 1 Arapahoe County sales tax 375 Littleton tax and 11 Special tax.

3 lower than the maximum sales tax in IL. There is no applicable city tax or special tax. The census directly impacts funding Littleton will receive over the next decade.

The sales tax jurisdiction name is Mcdonough which may refer to a local government division. Free listing in the Littleton Business Directory. Littleton Colorado 80120 Map.

The minimum combined 2022 sales tax rate for Littleton Colorado is 8. ETRAKiT Portal. Littleton in Colorado has a tax rate of 725 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Littleton totaling 435.

You can find more tax rates and allowances for Littleton and Colorado in the 2022 Colorado Tax Tables. Lone Tree CO Sales Tax Rate. Welcome to the City of Littleton Business SalesUse Tax E-Government Website.

Interactive Tax Map Unlimited Use. Business SalesUse Tax License Application Short-Term Rental License Application. Lindon CO Sales Tax Rate.

SALESUSE TAX RETURN 2255 W. The Colorado sales tax rate is currently 29. The 7 sales tax rate in Littleton consists of 475 North Carolina state sales tax and 225 Warren County sales tax.

BERRY AVENUE LITTLETON CO 80120 303-795-3768 M D YYYY M D YYYY COMPANY NAME ADDRESS CITY STATE ZIP CODE PERIOD COVERED DATE DUTE. State of Colorado Sales Tax Changes. The December 2020 total local sales tax rate was 7250.

1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee. This is the total of state county and city sales tax rates. TaxColoradogov Page 1 of 1 2020 Consumer Use Tax Reporting Schedule Use this schedule to report consumer use tax due.

In 2020 the city rolled out a huge new upgrade to its Building Permit and Development Review System. Ad Lookup Sales Tax Rates For Free. Loma CO Sales Tax Rate.

You can print a 7 sales tax table here. Lochbuie CO Sales Tax Rate. 5 series 2020 6 7 an ordinance of the city of littleton 8 colorado amending section 3-9-1-2 and adding 9 section 3-9-1-8 of thelittletonmunicipalcode 10 regarding economic nexus and the 11 obligation of remote sellers to collect and 12 remit sales tax 13 14 whereas the city of littleton colorado the city is a home rule.

There is no applicable city tax or special tax. Longmont CO Sales Tax Rate. Complete this form click the print button below sign date and mail to City of Littleton Sales Tax Division.

Population counts determine the annual allocation of more than 800 billion in federal investment to states counties and cities. 5 Food for home consumption. The Littleton Colorado sales tax is 725 consisting of 290 Colorado state sales tax and 435 Littleton local sales taxesThe local sales tax consists of a 025 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

Enter the total purchases for which state sales or use tax was not previously paid. The Littleton sales tax rate is 375. For tax rates in other cities see North Carolina sales taxes by city and county.

Livermore CO Sales Tax Rate. 3 Cap of 200 per month on service fee. This is the Colorado Retail Sales Tax Return.

File Sales Tax Online Department Of Revenue Taxation

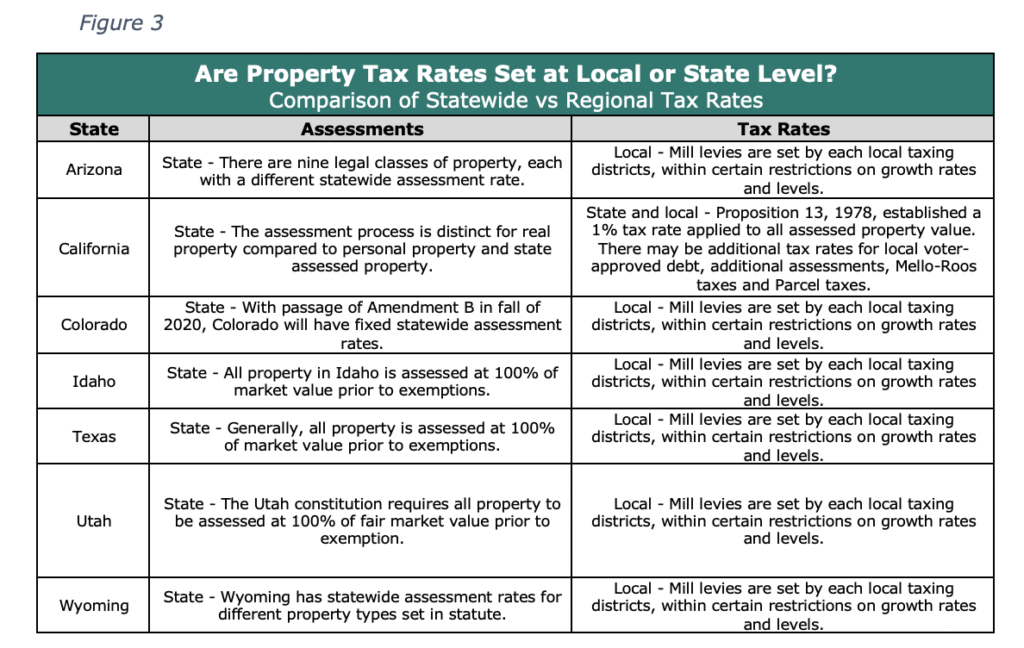

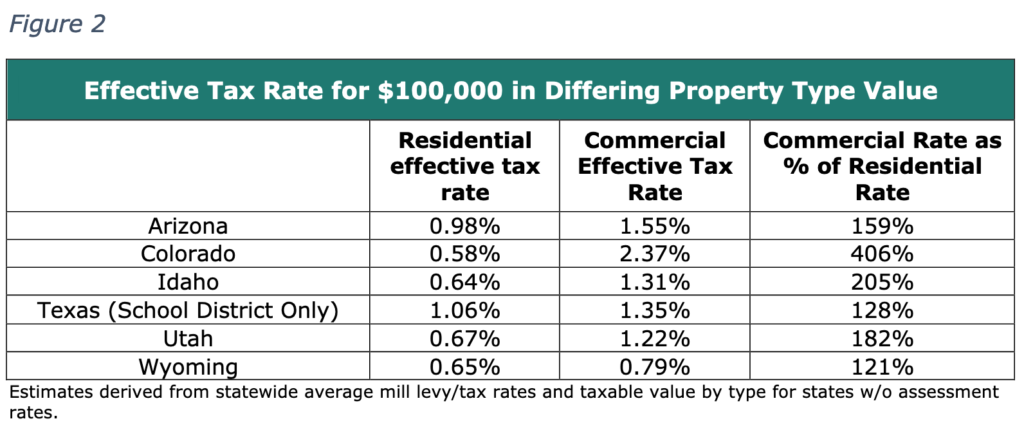

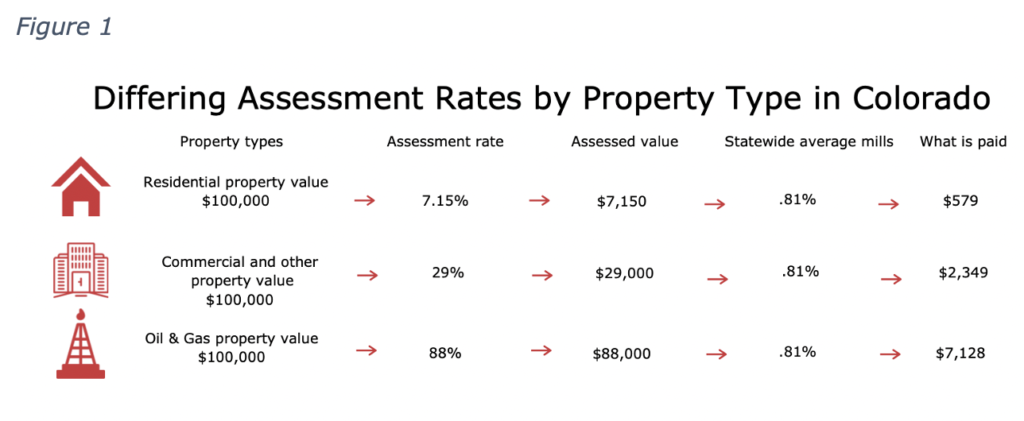

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

File Sales Tax Online Department Of Revenue Taxation

Business Sales Use Tax License Littleton Co

2016 Kia Soul Ev Incentives Specials Offers In Olympia Wa Kia Kia Soul Arapahoe

2016 Kia Soul Ev Incentives Specials Offers In Olympia Wa Kia Kia Soul Arapahoe

Sales Tax Guide Department Of Revenue Taxation

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

40138 Lakeview Dr Big Bear Ca 92315 4 Beds 6 Baths Big Bear Lake Lake View Waterfront Homes

Parsons Home For Sale Waterfront Homes Home House Styles

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

2016 Kia Soul Ev Incentives Specials Offers In Olympia Wa Kia Kia Soul Arapahoe

Colorado Sales Tax Rates By City County 2022

File Sales Tax Online Department Of Revenue Taxation